Can A Holding Company Legally Own A Nonprofit?

Holding Homes In Llc Under 501 C 3 Nonprofits (Should You?)

Keywords searched by users: Can a holding company own a nonprofit can a for-profit company have a non profit subsidiary, nonprofit holding company, who owns a nonprofit, can a nonprofit own property, can a nonprofit partner with a for-profit, can a trust own a nonprofit, examples of nonprofits with for-profit subsidiaries, what is a disadvantage of a non-profit owning a for-profit subsidiary?

Is There Owners Equity In A Not For Profit Organization?

Is there owner’s equity in a not-for-profit organization?

Not-for-profit organizations differ from for-profit entities in terms of ownership structure. In a not-for-profit organization, there are no individual owners, as these organizations are typically established to serve a specific mission or charitable purpose. Consequently, the concept of owner’s equity, commonly found in for-profit businesses, does not apply to not-for-profits.

Instead, not-for-profit organizations utilize a different financial framework to assess their financial health. They generate a Statement of Financial Position, which is akin to a balance sheet in for-profit entities. This statement outlines the organization’s total assets and total liabilities, similar to a traditional balance sheet. However, in the case of not-for-profits, the equivalent of owner’s equity is represented by net assets, which encompass the difference between total assets and total liabilities. This distinction helps stakeholders, such as donors and grantors, understand how resources are being utilized to further the organization’s mission.

In summary, while not-for-profit organizations lack traditional owners and owner’s equity, they rely on the concept of net assets to demonstrate their financial position and commitment to their charitable objectives. This approach is critical for transparency and accountability in the not-for-profit sector.

What Is The Best Structure For A Nonprofit Organization?

Designing the optimal structure for a nonprofit organization involves careful consideration of its key functional components, which are typically divided into three main areas: Governance, Administration, and Programs. These three pillars are crucial for the effective functioning of a nonprofit. Governance oversees the strategic direction, decision-making, and board leadership of the organization. Administration encompasses the day-to-day operations, financial management, and human resources. Programs focus on the core activities and initiatives that fulfill the nonprofit’s mission and serve its beneficiaries. To provide a clear visual representation and enhance transparency, nonprofits often create organizational charts that illustrate the relationships and responsibilities within these areas. These charts are valuable tools for both internal staff and external stakeholders, offering insight into how the nonprofit operates and delivers its mission to the public.

Found 26 Can a holding company own a nonprofit

Categories: Aggregate 96 Can A Holding Company Own A Nonprofit

See more here: maucongbietthu.com

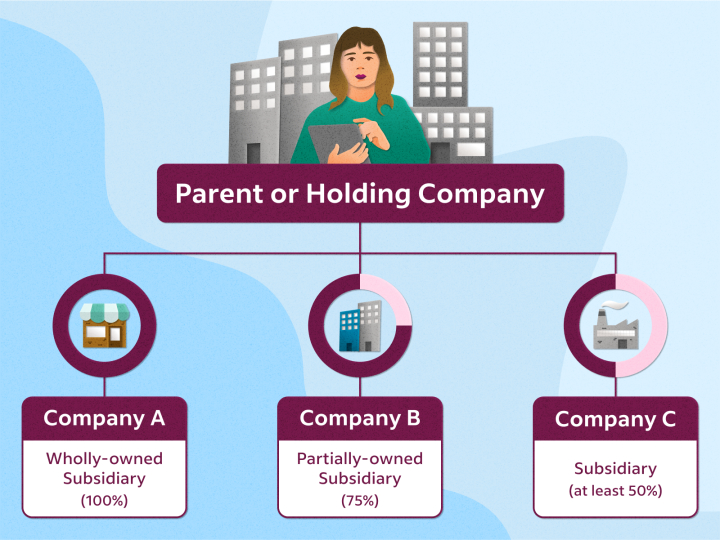

Because the nonprofit doesn’t have owners, a for-profit cannot “own” a nonprofit. However, a corporation can still align itself with a nonprofit without ownership. Adding a nonprofit or charitable arm to your for-profit company is possible, as long as you are careful to follow IRS rules and restrictions.Nonprofits do not have owners. As a result, nonprofits do not nave owner equity. In both cases, net assets equal the difference between the total assets and total liabilities. However, nonprofits generate the Statement of Financial Position which only presents revenue, assets and liabilities.

Learn more about the topic Can a holding company own a nonprofit.

- Can a For-Profit Business Add a Nonprofit Arm?

- Statement of Financial Position: What are Nonprofit Net Assets? – Araize

- Nonprofit Organizational Charts: What are They and Why are They Vital?

- Owner’s Equity: Definition and How to Calculate It – NetSuite

- Can a non-profit organization be a subsidiary within a …

- Non Profit Holding Company: Everything You Need to Know