Can A Credit Card Debt Be Collected After 7 Years? Exploring The Legal Limits

After 7 Years What Happens To Debt

Keywords searched by users: Can a credit card debt be collected after 7 years does credit card debt go away after death, does credit card debt go away after 7 years, what happens to unpaid credit card debt after 7 years, can i be chased for debt after 10 years, capital one credit card debt statute of limitations, credit card statute of limitations by state, can a debt collector take you to court after 7 years, how to remove items from credit report after 7 years

What Happens If You Don’T Pay A Credit Card After 7 Years?

If you fail to pay a credit card debt for an extended period, specifically seven years, you might be wondering about the consequences. Firstly, it’s important to know that unpaid debt does have adverse effects on your credit report and credit score. However, the silver lining is that these negative impacts are not permanent. After a span of seven years, unpaid credit card debt will typically be removed from your credit reports. It’s crucial to note that the debt itself doesn’t magically disappear, but it does cease to have any influence on your credit score. This means that as of October 10, 2022, if you had a credit card debt that went unpaid for seven years or more, it should no longer be a factor affecting your creditworthiness.

Does Credit Card Debt Get Written Off After 7 Years?

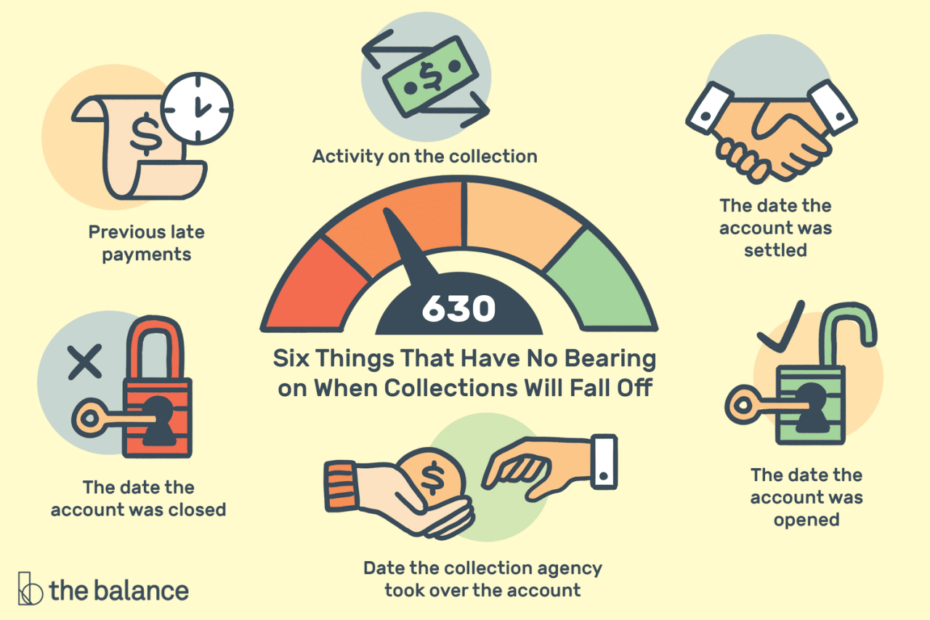

Is credit card debt forgiven after 7 years? This question often stems from a widespread misunderstanding related to the timing of debt removal from your credit report. While it is true that many debts are removed from your credit report after 7 years, it’s essential to clarify that the debt itself doesn’t vanish. Instead, it simply stops appearing on your credit report. Even after this period, creditors may still legally pursue outstanding debts. This means that while the negative impact on your credit score may diminish after 7 years, you may still be responsible for repaying the debt. It’s crucial to be aware of the distinction between the removal of debt from your credit report and the actual legal obligations associated with it.

What Happens To Unpaid Credit Card Debt After 7 Years In Malaysia?

In Malaysia, when it comes to unpaid credit card debt, a significant change occurs after a period of 7 years. After this seven-year timeframe has elapsed, creditors no longer have any legal recourse to pursue the outstanding debt from the borrower. Specifically, unsecured debts are legally considered “expired” after six years have passed since the last payment or communication regarding the debt. Importantly, this means that creditors cannot initiate any legal actions to recover the owed money, and debtors are protected from legal repercussions for the unpaid debt. This legal provision offers clarity and protection to both creditors and debtors involved in unresolved credit card debts in Malaysia, ensuring a fair and balanced approach to debt management. Please note that the information provided here is accurate as of my last knowledge update in September 2021, and it’s essential to consult with legal professionals or refer to the latest legal regulations for the most up-to-date information on this topic.

Update 14 Can a credit card debt be collected after 7 years

:max_bytes(150000):strip_icc()/creditreportdebt7years-c0922fce9f4b4e999f890bba01f5a005.jpg)

:max_bytes(150000):strip_icc()/state-by-state-list-of-statute-of-limitations-on-debt-960881-17dca963dbe14826877ea1e67a87451e.jpg)

:max_bytes(150000):strip_icc()/debt-validation-requires-collectors-to-prove-debts-exist-960594-V1-a13dc2e2066f49c38ebc05f515de9492.jpg)

:max_bytes(150000):strip_icc()/remove-debt-collections-from-your-credit-report-960376_FINAL-5ae6517517024613885ec46df1e58ecd.png)

:max_bytes(150000):strip_icc()/how-debt-collection-agency-business-works.asp_Final-d52ff61e187e4113879e73bb782bbc5e.jpg)

Categories: Aggregate 71 Can A Credit Card Debt Be Collected After 7 Years

See more here: maucongbietthu.com

Learn more about the topic Can a credit card debt be collected after 7 years.

- Can debt collectors collect a debt that’s several years old?

- What Happens to an Unpaid Credit Card Debt After 7 Years?

- The Statute Of Limitations on Debt – Consolidated Credit Canada

- DebtCollector.my – Debt Collection Law in Malaysia

- Here’s What Happens If You Never Pay Your Credit Card Bill

- Can debt collectors collect a debt that’s several years old?