Can A Debt Be Too Old To Collect? Exploring Debt Collection Time Limits

How Long Can A Creditor Collect An Old Debt? 🤔

Keywords searched by users: Can a debt be too old to collect can i be chased for debt after 10 years, if a debt is written off can it still be collected, statute of limitations by state for debt collection, should i pay a debt that is past the statute of limitations, does disputing a debt restart the statute of limitations, statute of limitations on credit card debt, how many times can a debt be sold, how to remove debt from credit report after statute of limitations

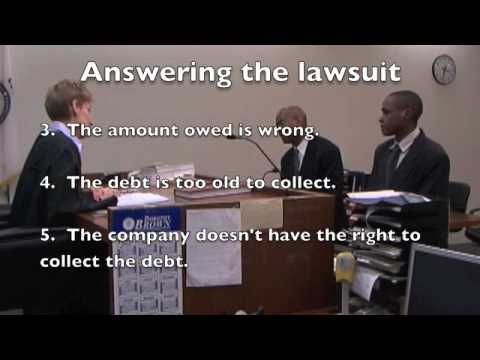

Can I Be Chased For An Old Debt?

Is it possible for a past debt to come back to haunt you? Many people wonder if there’s a time limit for creditors to pursue old debts. Well, the answer is yes, but it comes with some important conditions. Generally, there is no specific time limit for creditors to enforce a court order for debt collection. However, if the court order in question was issued more than 6 years ago, there’s an additional step the creditor must take. In such cases, the creditor needs to obtain court permission before they can engage bailiffs to collect the debt. This means that while there isn’t an absolute time limit, the creditor’s ability to use bailiffs becomes subject to court approval after 6 years have passed since the court order was issued. This legal nuance is crucial for individuals who may be concerned about the possibility of being pursued for an old debt.

What Happens After 7 Years Of Not Paying Debt?

What occurs after seven years of non-payment of a debt? Typically, after seven years from the date of your initial missed payment, most negative items on your credit reports should automatically be removed. This process can lead to an improvement in your credit scores. However, it’s important to note that if you are responsibly managing your credit during this period, your credit score may bounce back to its original level within a range of three months to up to six years. This information is accurate as of October 10, 2022.

Should I Pay A Debt From 10 Years Ago?

Question: Is it necessary to repay a debt that dates back a decade or more?

Answer: If you’re wondering about paying off a debt that’s been lingering for over a decade, there are some important considerations. Firstly, if the delinquent debt is still appearing on your credit report even after 10 years, you should take action by disputing it with the credit bureaus to ensure the accuracy of your credit history. Secondly, it’s worth noting that, in many cases, creditors may no longer have the legal right to collect on debts that have surpassed the statute of limitations, which is often around 7-10 years depending on your location and the type of debt. Therefore, you may not be legally obligated to repay such old debts, but it’s essential to be informed about your specific situation, as the rules can vary by jurisdiction and type of debt.

Discover 40 Can a debt be too old to collect

:max_bytes(150000):strip_icc()/what-happens-if-you-dont-pay-a-collection-960591-v3-5bbe02b546e0fb00510fde7e.png)

:max_bytes(150000):strip_icc()/statute-of-limitations-4188623-v2-final-ea089264e0684f558b90b959d85adda9.png)

:max_bytes(150000):strip_icc()/debt-validation-requires-collectors-to-prove-debts-exist-960594-V1-a13dc2e2066f49c38ebc05f515de9492.jpg)

:max_bytes(150000):strip_icc()/how-debt-collection-agency-business-works.asp_Final-d52ff61e187e4113879e73bb782bbc5e.jpg)

Categories: Update 67 Can A Debt Be Too Old To Collect

See more here: maucongbietthu.com

Learn more about the topic Can a debt be too old to collect.

- Can debt collectors collect a debt that’s several years old?

- Check if you have to pay a debt – Citizens Advice

- When Does Debt Fall Off Your Credit Report? | Bankrate

- Should I Pay Off 10 Year Old Credit Card Debt? – Ask The Money Coach

- Can debt collectors collect a debt that’s several years old?

- What Happens to an Unpaid Credit Card Debt After 7 Years? – MoneyLion